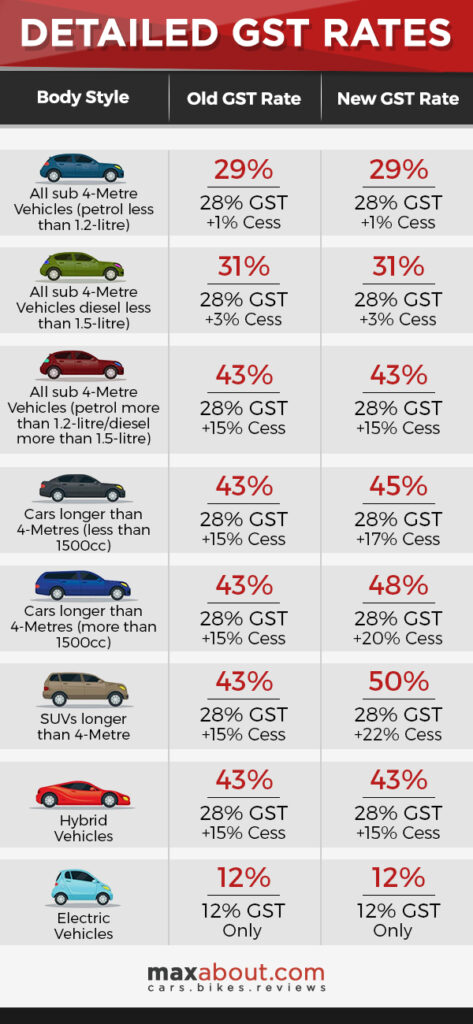

A recent amendment in GST slabs for automobiles brought increase in the overall values for mid size, luxury and SUV segments. As expected, the GST for sub 4 meter petrol and diesel cars with engine displacement less than 1.2L and 1.5L respectively was kept the same.

This equates to 29% (28+1) for small petrol cars and 31% for same segment diesel cars. This helps all cars like Baleno, i20 Elite, Dzire and Amaze retain their present price tags. Another sub 4 meter segment that comes with engines bigger than the above given limit also stays intact at 43% GST (28+15).

Next clause comes when a car exceeds the 4 meter length barrier. Government will now charge 45% (28+15+2) for mid size cars and 48% (28+15+5) for those falling in the large car segment. Worst hit segment remains SUVs as they will now fall under 50% GST slab (28+15+7).

Next clause comes when a car exceeds the 4 meter length barrier. Government will now charge 45% (28+15+2) for mid size cars and 48% (28+15+5) for those falling in the large car segment. Worst hit segment remains SUVs as they will now fall under 50% GST slab (28+15+7).

As notification regarding this matter arrived today, the changes are already applicable on all given segment. The plan for cess hike was initially 10% but came out to be 2%, 5% and 7% for these three segments. Apart from these, hybrid and electric cars retain their 43% and 12% of already fixed slab.

Here is how the correct division of segments occurs among these cars:

Here is how the correct division of segments occurs among these cars:

# Small Car (Petrol) – Less than 4 meter, engine displacement less than 1.2L, 29% GST

# Small Car (Diesel) – Less than 4 meter, engine displacement less than 1.5L, 31% GST

# Small Car – Less than 4 meter, engine displacement greater than 1.2L (petrol) and 1.5L (diesel), 43% GST

# Midsize Car – Greater than 4 meter, engine displacement not greater than 1.5L (petrol & diesel), 45% GST

# Large Car – Greater than 4 meter, engine displacement greater than 1.5L, 48% GST

# SUV – Greater than 4 meter, ground clearance over 170mm, 50% GST

Every SUV over 4 meter will now fall under the highest taxed slab while those under the compact section are free from any price hike in coming days. This will result in lower sales in the upcoming festive season for bigger cars. Most affected manufacturers from this hike are luxury manufacturers while brands like Mahindra even have a considerable section under SUV category. As cess on petrol and diesel small cars remain the same, they are expected to sell in even large numbers than before during the festive season. Most manufacturers have not yet updated their price lists online.

Every SUV over 4 meter will now fall under the highest taxed slab while those under the compact section are free from any price hike in coming days. This will result in lower sales in the upcoming festive season for bigger cars. Most affected manufacturers from this hike are luxury manufacturers while brands like Mahindra even have a considerable section under SUV category. As cess on petrol and diesel small cars remain the same, they are expected to sell in even large numbers than before during the festive season. Most manufacturers have not yet updated their price lists online.

Falling income of states is the biggest reason behind this tax hike while it is even believed that affordability percentage of buyers in this segment is higher than any other existing segment. Brands actually plan their products according to government regulation as it’s hard to find a car with less than 4 meters of length and a bigger engine than 1.2L petrol and 1.5L diesel limit, saving the 43% rate to just 31% in most cases (as done with Maruti Dzire few years ago). Still, the suffering rises when they have a full fledged festive season in front after such a huge tax rise.