The brand wise sales for major Indian motorcycle manufacturers saw an increase while very few saw a decline for the month of March 2017 in the country. The product wise sales report for every Indian motorcycle and scooter builds a bridge between gainers and losers for the last month of FY 16-17. The best selling motorcycle from the Bajaj stable is definitely Pulsar while it was closely followed by Platina and CT100. Hero MotoCorp benefited from the BS3 sales and sold Splendor as well as HF Deluxe in six digit numbers.

![Brand-Wise-Sales-Report-of-Bikes-&-Scooters-[March-2017]](https://news.maxabout.com/wp-content/uploads/2017/04/Brand-Wise-Sales-Report-of-Bikes-Scooters-March-2017.png)

Brand-Wise Sales Report of Bikes & Scooters [March 2017]

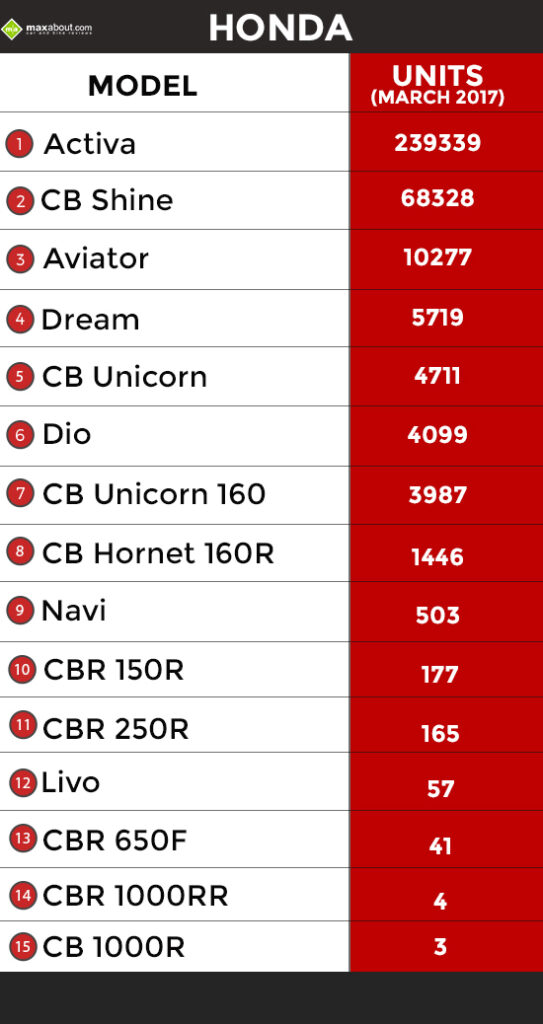

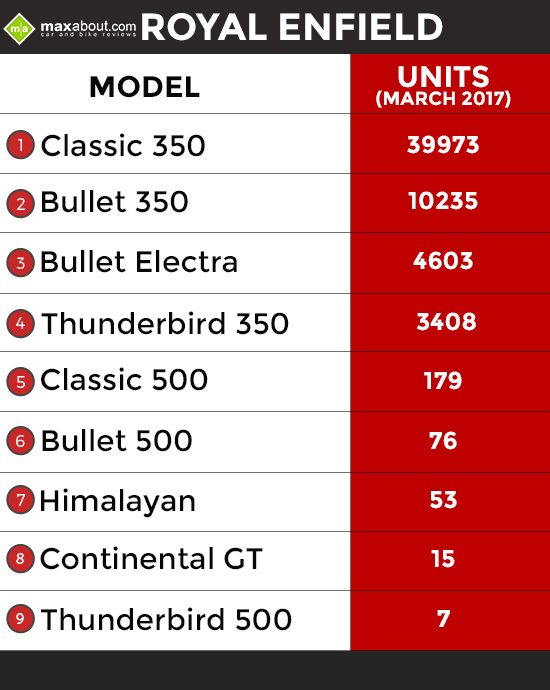

Honda Activa was the number one seller with 2,39,339 units moving out of the dealerships. No other product in the Honda lineup got the same attention of the buyers. Royal Enfield Classic 350 was the number one seller in the company lineup, selling more units than most others in the price segment. Suzuki Access sold 28,151 units and went on to become the most selling Suzuki product. TVS Jupiter crossed 60,000 sales mark while Yamaha Fascino was the highest selling product in the company lineup.

Honda Activa is the Most-Selling 2-Wheeler in India

Premium motorcycle segment saw Triumph selling 18 units of Thunderbird Storm while Harley Davidson moved 118 units of Street 750. KTM sold 2080 units of the Duke 200 in March 2017. Kawasaki Ninja 650 sold 152 units in the same month, clearing the stocks of old generation model. Other brands like Aprilia sold 2421 units of SR150 scooter in March 2017 while Mahindra Gusto could fetch 1134 buyers. 2310 Vespas were even sold in the same period.

Vehicle-Wise Sales Figures for 13 Motorcycle Brands

*Sales Figures for KTM RC Models Not Available

Data Source: AutoPunditz

Monthly Sales Comparison for Most Popular Motorcycle Brands in India

March 2017 saw drastic changes in the sales report of most automobile brands in India. All of the credit goes to BS3 ban as the profits were dipped and sale was boosted in order to clear the unsold stock from every dealership. This benefited the customers to a great extent and helped automakers post epic sales figures of all time. While some were enjoying the number game, few manufacturers registered negative growth in the same month.

1) Yamaha (View Range)

March 2016 – 60,032 Units

March 2017 – 76,114 Units

Growth by 27 percent

Yamaha India witnessed a growth of 27 percent as it sold a total of 76,114 units in March 2017. The same month last year saw just 60,032 units moving out of the dealerships. Yamaha even benefited from the increase in sales of its scooters and commuter motorcycles. The popular R15 and FZ series still sells in limited numbers while the presence of first generation FZ even helped the brand’s growth by keeping fans closer to its roots.

2) Suzuki (View Range)

March 2016 – 20,673 Units

March 2017 – 36,029 Units

Growth by 74 percent

Suzuki India is the only brand to report such high growth (74 percent) in the month of March 2017. The total number of units sold reached 36,029 while the same month last year saw only 20,673 units moving out of the dealerships. They expanded extensively in the last financial year and reached much more audience than ever before. The annual sales mark even crossed 3,50,000 units for the first time.

3) Hero MotoCorp (View Range)

March 2016 – 6.06 lakh Units

March 2017 – 6.10 lakh Units

Growth by 0.48 percent

Hero MotoCorp was the only manufacturer that crossed the six lakh mark in the month of March 2017. It registered total sales of 6,09,951 and gained just 0.53 percent from last year’s 6,06,542 units for the month of March. They just offered a max of INR 12,500 off on their products and nearly sold everything on the second day of the sale. The amount of growth from their side was not that attractive as they focus mainly on commuter motorcycles.

4) Royal Enfield (View Range)

March 2016 – 51,320Units

March 2017 – 60,113 Units

Growth by 17 percent

Royal Enfield registered a growth of 17 percent, thanks to the extensively selling Classic 350 in its lineup. March 2017 saw 60,113 units moving out to the customers while the same period last year had just 51,320 units. The fact seems a miracle as it is the most expensive brand out of all the top sellers and customers still prefer buying a motorcycle that is above INR 1.5 lakh on-road. Classic 350 even stood sixth in motorcycle sales chart for March 2017.

5) Honda 2-Wheelers (View Range)

March 2016 – 3.81 lakh Units

March 2017 – 3.65 lakh Units

Drop by 4.08 percent

The second most selling brand, Honda Motorcycle and Scooter India, sold a total of 50,08,103 units in the financial year 2016-2017. Honda sold a total of 3,65,973 units in March 2017 while they sold 3,81,524 units same month last year. The year-on growth is 12 percent as they sold 44,83,462 units in FY 2015-2016 while monthly decline in sales is 4.08 percent. The highest selling product in the lineup is Activa and current stats makes the fact clear that 6 Activas are sold out of total 10 two-wheelers from Honda dealerships across India.

6) Bajaj (View Range)

March 2016 – 2.64 lakh Units

March 2017 – 2.44 lakh Units

Drop by 12 percent

The second brand that saw a decline in monthly sales was Bajaj Auto, registering a total decline of 8 percent in the monthly sales. The total motorcycles that moved out from the dealerships in March 2017 were 2,44,235 while the same month last year saw 2,64,249 units. The only reason for the same can be Bajaj’s BS4 compliant strategy as they were months ahead of the deadline and offered the least amount of discounts in the month of March 2017.

7) TVS (View Range)

March 2016 – 2 lakh Units

March 2017 – 2.17 lakh Units

Growth by 8.4 percent

TVS saw an increase in its sales by a good margin. The 8.4 percent growth saw major increase in its scooter sales while the overall sales for March 2017 stood at 2,16,995 units. The 2,00,190 sales mark was achieved last year in the same month. TVS was also offering heavy discounts on their products on last two days of the month. TVS is always fighting for the third or fourth spot in the highest selling brands in India every year.

Data Source: NDTV | Business Standard